Impact of GST on Indian Chess

From 1st of July 2017, Goods and Services Tax will be introduced in India. It will bring about an unprecedented change in how our indirect tax system works. Various indirect taxes like Service Tax, VAT, CST, excise etc. will be scrapped and single Goods and Services Tax will be levied. However, not even the best of experts are able to fully understand and explain the repercussions of GST being introduced. Experienced trainer and organizer of Mumbai FI Praful Zaveri has made a bold attempt to unveil the mystery. He tells us about how GST will affect chess coaching and tournament organization in India.

Impact of GST on Sports training activities and tournaments

In few hours from now independent India’s biggest tax reform in the form of Goods and Services Tax (GST) would be unveiled, which is going to signal a revolution with its new policies and regarding the ways we treat our taxation.

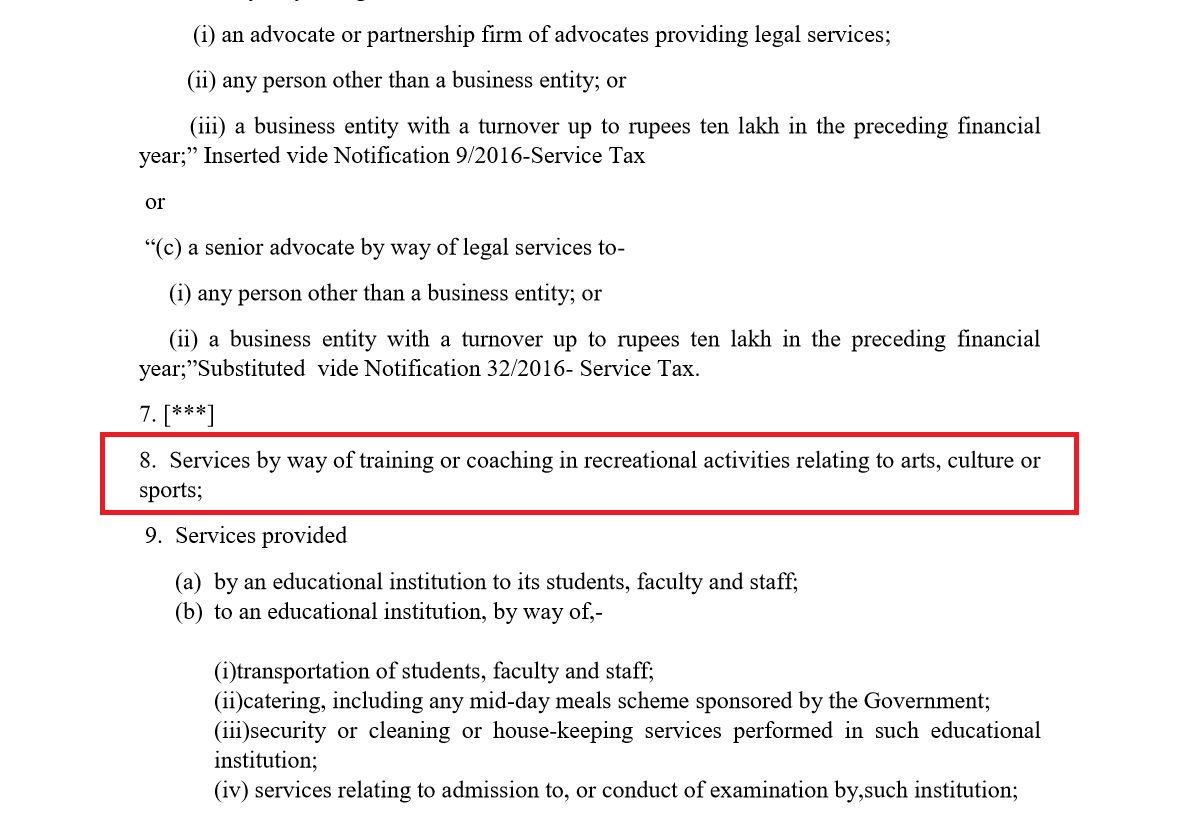

Before we move on to the impact of GST on sports, let us have a look at the older laws of the soon to be defunct ‘Service Tax’ (ST) on sports training activities.

A service provider was liable to pay ST on services provided at 15% of the value. However, the Government of India, in exercise of the powers conferred on them, used to exempt certain taxable services from the whole of the service tax leviable.

Why is such exemption granted to certain services by the Government? Well, the Government duty is to see the overall welfare of its subject and this can be achieved by supporting certain areas of public interest.

Sports is one of them and accordingly, the services related to training in sports and recreational activities were exempted from the purview of Service Tax.

What it means that a service provider of training or coaching in recreational activities relating to sports was not liable for payment of service tax and this was irrespective of the turnover achieved by him (or the entity – Private, Public, Charitable Institution, Society, etc).

Changes Post GST:

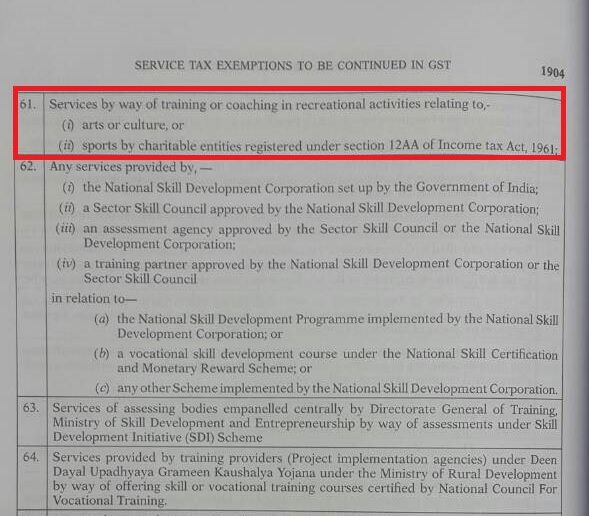

Now in the GST regime, things have been modified and the entry of exemption (para 61 - page 1904) states:-

Service tax exemption in GST will be continued only for services by way of training or coaching in recreational activities in relation to 1. Arts or culture or 2. Sports by charitable entities registered under section 12AA of Income Tax Act 1961.

From the modification given above, Sports has moved away from Arts/Culture (para 8 above). It also means that only charitable entities who are registered under section 12AA of the IT Act, 1961 are exempted from the purview of GST and the remaining entities or individuals who have crossed the minimum threshold turnover limit of 20 lakhs in the previous Financial Year (2016 – 2017) are liable to register with GST and pay GST @ 18% for services extended from 01 July, 2017.

Of course, the entity would be getting input credits for the GST paid by them in various forms to provide these services.

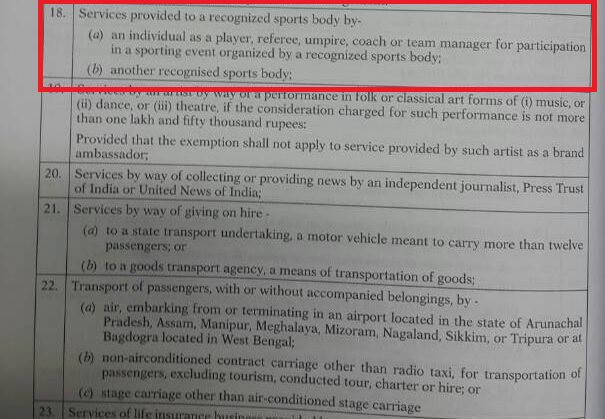

There is one more exemption entry (Para 18 – Page 1900) as below:-

Services provided to a recognized sports body by:-

(a) An individual as a player, referee, umpire, Coach or a team manager for participation in a sporting event organized by a recognized sports body.

(b) Another recognized sports body

This basically means that all sports federations and its affiliates are exempted from paying GST. However, it does not apply if the services is given by a non-recognized sports body to a recognized sports body and here the former is liable for GST.

From my interpretation of the above, it is clear that all chess trainers in their individual capacity and academies (tournament organizations included) in the form of profit making entities would be liable for GST.

Of course, it is final customer (read ‘Students) who are going to bear this liability as trainer would be collecting the GST from them. However, it will take time for the end customer to come to terms with this, as hitherto sports was exempted!

So, do not be surprised if you find future tournament circulars by non-charitable entities as under:

‘The entry fee for the tournament is Rs.2,000/- + Rs. 360/- GST @ 18% or Rs.2360/- inclusive of GST.

On the brighter side, Corporates would come forward to extend sponsorship to the tournament organizers having GST registration as they can get credit inputs for the services extended to them.

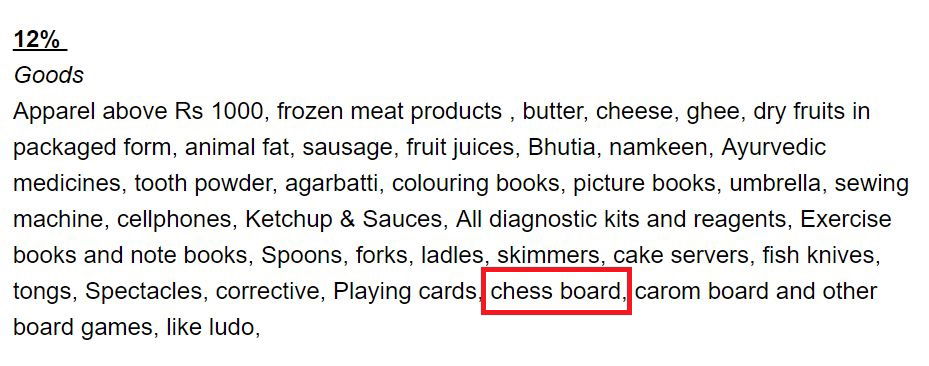

GST on chess products:

Before closing, I have to state that GST is here to stay and we need to embrace it as it is bound to boost the development of ever growing Indian economy by removing barriers created by States and bringing a national integration! However, on a personal note it would be have more welcomed with a lower rate of GST as India needs to make a mark in sports and this is one area of utmost priority.

Some Cartoons on GST:

What's your take on GST? Mention it in the comments section below.

About the author:

FI Praful Zaveri is the founder of Indian Chess School Academy. He is a popular trainer in Mumbai and also the author of the critically acclaimed Chess Course book for beginners. His vision is to build the chess culture in his hometown Mumbai as well as India and help the country produce many more grandmasters in future. For this he has been the organizer of some huge projects like the IIFLW tournament, regular high class events and training sessions.